After five plus years in this business, you bet I got a few bumps and bruises. Unlike what you see on TV, this is, by no means, a get rich quick business. So take some time and plan. Set deadlines then take actions so you don’t get into an “analysis, paralysis” situation. I had a mentor who is a very prominent investor in our industry and I highly recommend you seek out one or a few for yourself.

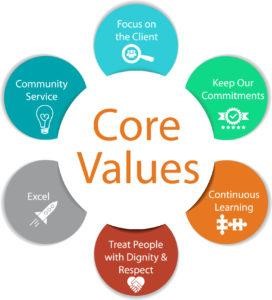

BEGIN WITH YOUR CORE VALUES

For a long time, I hired and fired so many employees. I couldn’t figure out what I was doing wrong. I thought I was just bad at this whole process. As it turned out, I did not have my core values written down. Deep down inside, I have always known my core values, but until I had them written down and printed on the wall, I hired people who had different core values. Now, we hire and fire based on our core values. Having these values carved in stones help you identify your future team members or business partners when you see them. I highly recommend these books: Traction and The E-Myth Revisited.

SET YOUR GOALS

Dream BIG and set BIG GOALS. If money wasn’t an issue and you have no limitations, how big of a company would you have? Write it down. Having goals helps you define purpose, measure progress, and feel accomplished.

There are some questions you should ask yourself..

- Where do you want to be in 1 year, 3 years, 5 years, and as far as 10 years?

- How much revenue will your company do a year?

- How many properties do you want to buy, wholesale, flip, or hold a year? Hence this will decide your exit strategies.

- How many people are in your company?

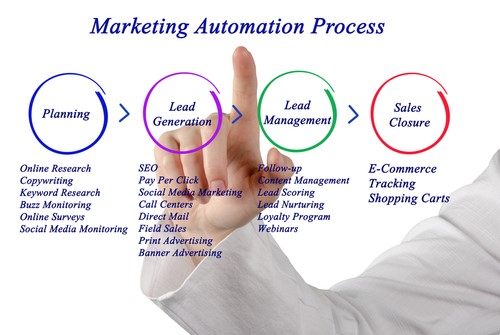

HAVE A PLAN ON LEAD GENERATION

This is probably your single most important and most expensive piece to figure out when you are new. Without leads, how will you buy any houses? There are two ways: Buying into a lead generation system or self-generate leads.

Lead Generation System: HomeVestors franchise has one of the best track records in this field. Over the past few years we have had new players like REIvault, WeBuyHouses,etc.

Self-Generate – The oldest way in the book is direct mail, and it’s still working in today’s world. There are other methods like bandit signs, SEO, door knocking, MLS, cold calling, brokerage relationships and more

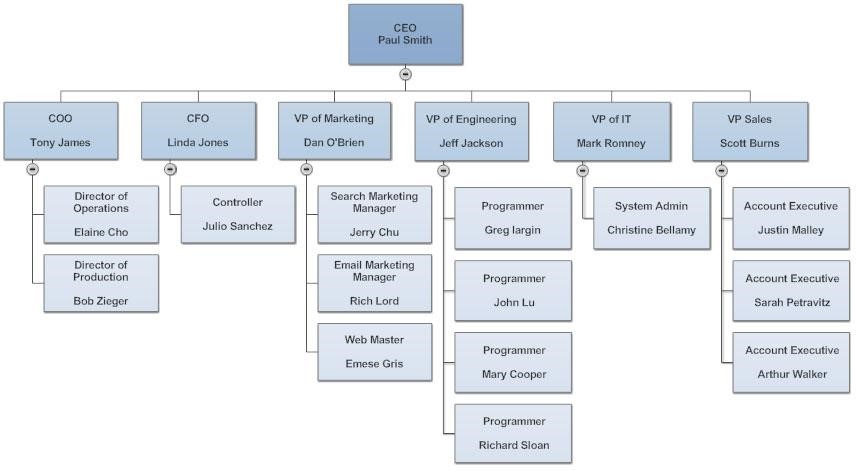

DRAW OUT BUSINESS ORGANIZATIONAL CHARTS

I made this mistake myself and I hope I can save you lots of money here. I was a single operator for a long time and I was bad at not documenting my processes. My advice to you is that even though you are just starting out and you might be the only person in your company, you need to run it like you have a team of 10. Map out your company’s organizational charts with CEO, COO, department heads, etc,. Document your processes and revise periodically. Know your strengths and hire or partner with people who would compliment you.

Have Funding In Place

Let’s get down to the knitty gritty. So you have painted a picture and you are super excited. What’s next? Well, despite what other gurus or so-called investors claim, you will need MONEY!

Start-up costs – These costs can vary from $50k to $100k which includes things such as building a website, having business cards, setting up entities, and more. Not sure how to set up your company, Anderson Advisors can certainly help you.

Operating costs – Some of these costs are your cost of living if this is your only source of income, cost of marketing and advertising, overhead costs, etc. Most new investors do not make money in the first six months. Be sure to plan appropriately, and have reserves!

Property Acquisition costs – How will you fund your deal? Often your exit strategies play a big role on which source of funds to use.

- Your own cash – Lowest cost of funds but you can run into a situation where you do not have liquidity to get yourself over the hump. Many investors fail for this reason.

- Private Lenders – Family and friends, business colleagues or other “deep pocket” individuals. This source of funds might be cheaper than hard money, however, it takes time to build trust and relationships. The process is probably easiest compared to other lenders.

- Hard Money Lenders – Asset based lenders. They often charge higher fees, but are quick and easy to work with. Have questions? Contact Jet Lending, our Strategic Partner for a free consultation.

- Institutions Like Banks – I like community banks the best. The downside, borrowers have to submit tax returns, proof of reserves, and financial statements. The upside, cost of funds is lower. So get to know some local business bankers in your area and start building relationships. It took me a year but I assure you, it is totally worth it.